Introduction

In the world of finance, the job of a bookkeeper frequently raises pictures of amount crunching as well as laborious information access. However, this impression neglects a critical aspect of bookkeeping: the rational prowess that improves raw economic records into important insights. In today's rapidly progressing economic landscape, businesses need to have much more than merely correct record-keeping; they need critical financial analysis to guide decision-making and also foster development. This post looks into the multi-dimensional role of bookkeepers in unlocking financial understandings and also highlights just how their logical capabilities could be the cornerstone for business success.

Unlocking Financial Insights: The Analytical Edge of a Bookkeeper

Bookkeepers do far more than preserve journals and keep track of expenses. They participate in an essential job in examining financial data to offer actionable insights that may determine strategic choices. By leveraging their rational functionalities, accountants may aid organizations pinpoint styles, anticipate future functionality, and also enhance financial operations.

The Development of Bookkeeping: From Data Admittance to Strategic Analysis

Historically, bookkeeping was actually frequently deemed a typical task centered only on conformity and record-keeping. Nonetheless, with advancements in innovation and transforming service mechanics, the function has actually grown significantly.

Technological Advancements Molding Bookkeeping

Cloud Accountancy Software: The increase of cloud-based services has actually changed how bookkeepers handle monetary information. Devices like QuickBooks as well as Xero permit real-time cooperation and also insightful reporting.

Automation: Automation resources lower hand-operated access inaccuracies, maximizing opportunity for bookkeepers to pay attention to analysis instead of rote learning tasks.

Data Analytics: Advanced analytics devices make it possible for bookkeepers to filter with big datasets swiftly, finding designs that can drive key decisions.

The Significance of Financial Analysis in Company Decision-Making

Why is actually economic analysis important? Comprehending where your funds stems from and where it goes is necessary for any company's longevity.

Identifying Trends

By studying historical information, accountants can determine fads that update potential strategies.

- Sales Trends: Assessing purchases with time helps companies recognize periodic fluctuations. Expense Patterns: Recognizing reoccuring expenditures can cause cost-saving opportunities.

Forecasting Future Performance

With precise information at their fingertips, bookkeepers may produce forecasts that assist budgeting and source allocation.

- Cash Flow Projections: Forecasting cash money influxes and streams makes sure liquidity. Revenue Forecasts: Estimating potential earnings assists in critical planning.

Key Analytical Capabilities Every Bookkeeper Must Master

To efficiently unlock economic insights, particular abilities are actually important. Here is actually a bookkeeping service deeper take a look at some must-have rational abilities:

Critical Thinking

The ability to examine situations objectively brings about educated decision-making.

Attention to Detail

Precision is actually type determining disparities within economic records.

Financial Reporting Skills

Being skilled at creating extensive files enables successful communication with stakeholders.

Deep Study Financial Metrics Bookkeepers Analyze

Understanding a variety of monetary metrics can unveil understandings that drive company success. Listed here are actually several essential metrics:

1. Earnings Margins

Profit margins show the amount of earnings a provider helps make relative to its profits.

Gross Revenue Margin

This mirrors the percentage of revenue remaining after subtracting direct expenses connected with production:

[\ textGross Earnings Frame = \ left( \ frac \ textRevenue - \ textCost of Product Marketed \ textRevenue \ right) \ times 100]

Net Earnings Margin

This takes into consideration total costs:

[\ textNet Revenue Frame = \ left( \ frac \ textNet Earnings \ textRevenue \ right) \ opportunities one hundred]

2. Return on Investment (ROI)

ROI evaluates the productivity of a financial investment about its own price:

[ROI = \ left( \ frac \ textNet Earnings \ textCost of Expenditure \ right) \ times one hundred]

Analyzing ROI assists local business owner determine which investments yield the very best returns.

3. Current Ratio

This ratio analyzes a business's ability to pay for short-term obligations:

[Existing Ratio = \ frac \ textCurrent Properties \ textCurrent Obligations]

A present ratio above 1 suggests really good temporary monetary health.

4. Debt-to-Equity Proportion (D/E)

This metric assesses a business's utilize by matching up complete responsibilities to investors' equity:

[D/E Proportion = \ frac \ textTotal Liabilities \ textShareholders' Equity]

A lesser ratio recommends a lot less threat for investors.

5. Cash Flow Analysis

Understanding capital-- both inbound and outward bound-- is actually essential for survival in any sort of organization environment.

Operating Cash money Flow

Indicates money created coming from usual operating activities:

[Functioning Cash Flow = Net Income + Non-Cash Expenses + Improvements in Working Capital]

How Bookkeepers Make use of Analytical Devices Effectively

Incorporating modern technology in to bookkeeping practices boosts rational capabilities substantially. Below is actually how various tools enter into play:

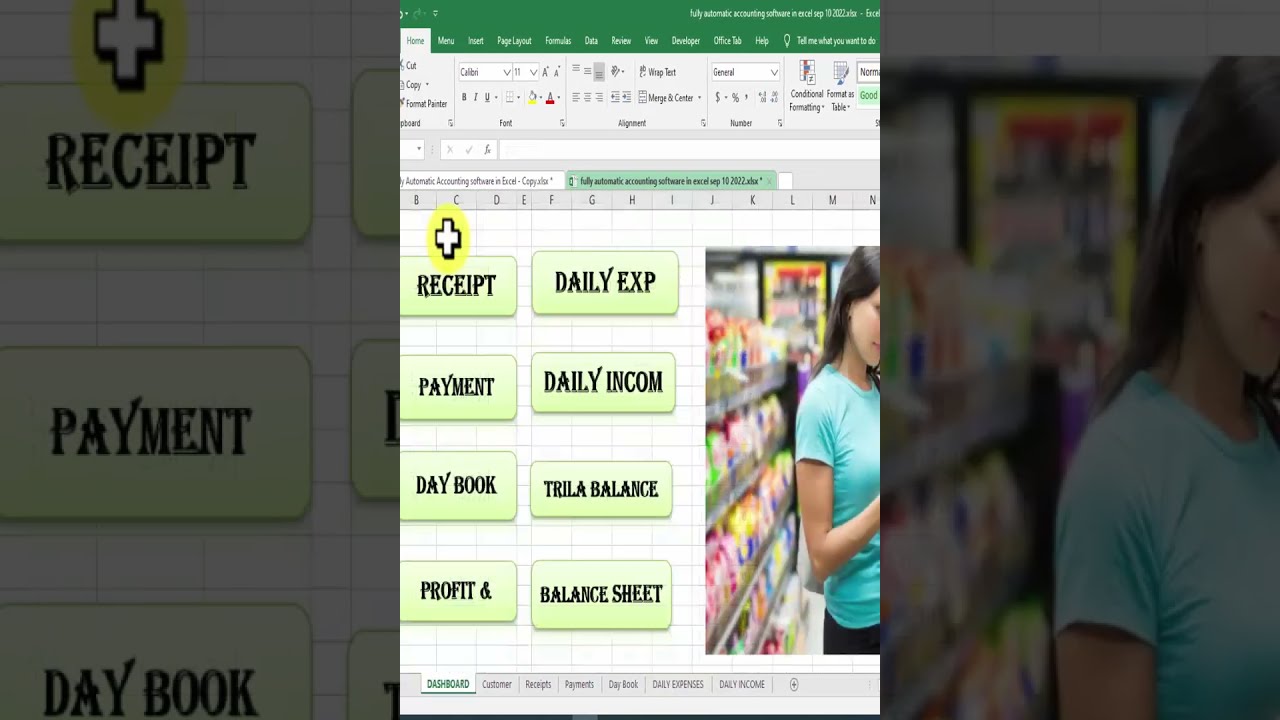

1. Spread Sheet Software Application (Excel & Google Linens)

These platforms allow sophisticated computations, pivot tables, and visuals images that help analysis.

2. Audit Software Program Features

Modern bookkeeping software program commonly includes built-in analytics resources that assist instantly produce files based upon real-time data inputs.

3. Information Visual Images Devices (Tableau & Power BI)

Using these tools enables bookkeepers to present facility information visually, making it simpler for stakeholders to digest relevant information quickly.

Common Challenges Faced by Bookkeepers in Study Workflows

custom bookkeeping solutionsWhile studying monetary data offers enormous value, there are problems that accountants run into routinely:

1. Records Overload

With extensive quantities of records offered today, distinguishing between helpful relevant information as well as sound can be daunting.

2. Staying on top of Regulative Changes

Financial policies continually advance; remaining certified while conducting in depth analyses requires carefulness and adaptability.

3. Integrating Systems Throughout Departments

When various divisions use dissimilar units for tracking financial resources or functions, merging this info into workable insights ends up being challenging.

Case Researches: Real-Life Applications of Bookkeeping Analytics

Analyzing case history exposes just how effective bookkeeping evaluation can easily impact organizations favorably:

Case Research study 1: Retailer Optimization

A regional store used advanced analytics coming from its bookkeeping files to pinpoint peak buying times and inventory turn over fees. Through adjusting staffing degrees during busy hours and also dealing with sell as needed, they enhanced sales through 25% over six months without boosting above costs.

Case Research study 2: Service-Based Business Growth

A service-oriented provider used thorough expenditure monitoring to examine client success across companies offered. By terminating low-margin companies while improving marketing initiatives towards high-margin offerings, they found an increase in overall productivity through 40%.

FAQs About Unlocking Financial Insights as a Bookkeeper

What certain logical skills must I establish as a bookkeeper?

Concentrate on developing essential assuming abilities in addition to effectiveness in spreadsheet software as well as accounting units analytics components-- these will serve you well!

How can easily I guarantee my reviews are actually accurate?

Double-check your job on a regular basis! Execute periodic evaluations of your items along with settlements along with financial institution statements or even billings-- this procedure will catch mistakes just before they come to be problems!

Are there accreditations offered for enhancing my analytical abilities?

Yes! Take into consideration going after certifications such as Accredited Monitoring Bookkeeper (CMA) or Chartered Global Management Accounting Professional (CGMA)-- these credentials stress analytical skills pertinent to pay for professionals!

What tools do professional accountants advise for analysis?

Popular options include Excel for standard tasks; QuickBooks or even Xero for accounting management; Tableau or Energy BI for advanced visualization requirements-- analyze your alternatives based on your certain requirements!

Can small companies gain from bookkeeping analytics?

Absolutely! Also business stand to obtain very useful insights through attentive monitoring-- understanding investing practices could lead all of them towards notable discounts over time!

What is actually the most effective method to found analyzed data?

Utilize aesthetic aids like charts or graphs along with concise rundowns when providing searchings for-- to make complex info digestible while involving stakeholders effectively!

Conclusion

In result, "Unlocking Financial Insights: The Analytical Edge of a Bookkeeper" reveals an often-overlooked size within this critical profession-- the energy of analysis embedded within day-to-day operations! As organizations browse considerably dynamic atmospheres marked by fast adjustment-- coming from technological technologies defining industries by means of brand new customer actions-- the demand grows more powerful than ever before!

Ultimately welcoming these logical elements not merely enriches traditional bookkeeping process yet also encourages aggressive tactics important for excellence moving forward! Those who invest opportunity cultivating these capabilities will find themselves situated profitably-- certainly not merely enduring however flourishing surrounded by difficulties ahead!